Over the recent years, more and more banks have begun to transform their customer-centric retail strategy from product-based risk management and operations of traditional banking, to bank-wide holistic customer oriented customer-level management. Via refined customer risk and credit demand quantitative models and strategies, the risk management, target marketing precision and customer stickiness can be improved. Ultimately by controlling risks, overall profit will be improved.

During the transformation process, Experian leveraged on our past experiences from local and global counterparts to design a set of customer-level risk management and business solutions, to assist retail banks to break through the barriers of inbank data and information, and build a consumer risk and yield model system. Through more accurate income estimation models, we designed a comprehensive personal credit line management system, for retail banks to meet regulatory requirements by strengthening unified personal credit management.

Building a single customer view

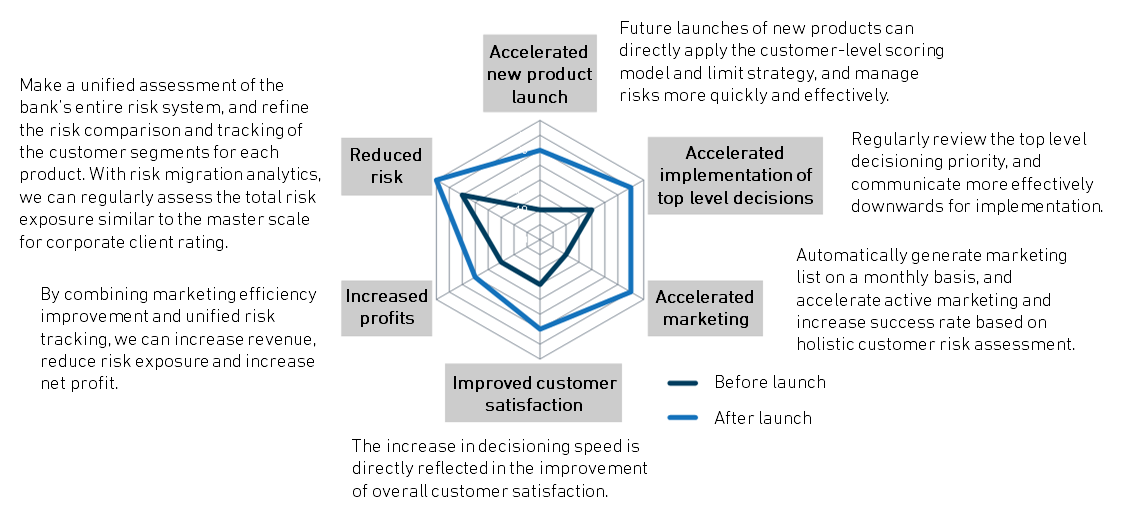

Under Experian’s retail customer-level risk scoring system, each customer has its own unified-scale customer level risk score corresponding to its default rate. Consistent risk levels across products make it easier for collaboration on risk management and customer engagement strategies at all stages of the lifecycle, such as new product sales, account management, upselling and risk warning. Establishment of consumer level risk and operation system can help commercial banks make a unified assessment in the overall risk system, effectively monitor the risk migration, and thus control risks. In addition, it can improve the accuracy of existing models and strategies in areas such as new product launch, and cross-selling, expand customer-level cross-selling and up-selling, and increase the overall revenue.

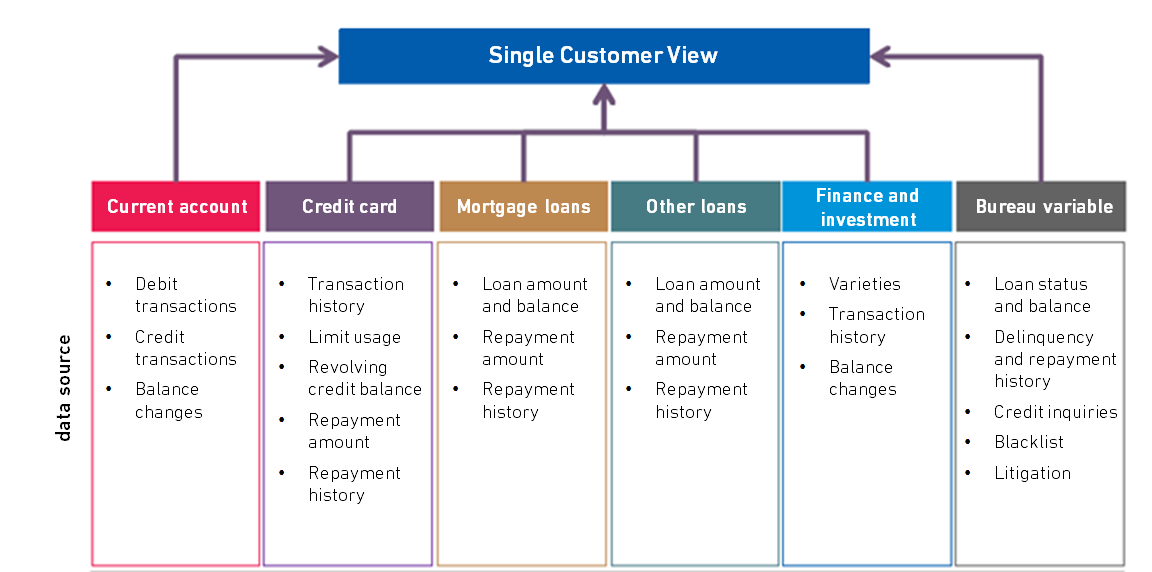

The foundation of customer-level risk management is to build a single customer view through the unification of all of the relevant data of the customers’ products in the bank, such as: their credit cards, installment loans, mortgage loans, other loans, saving accounts, investment and finance, credit data and other data, so as to have a more comprehensive understanding of the risks and values of customers in the bank ecosystem.

Similar to the traditional product-based risk scoring model, customer-level risk scoring can predict the future probability of customer default on the credit products. Just like the credit data interpretation of the People’s Bank of China, combining the data available in and/or outside the banking ecosystem to establish a holistic 360 degree index system, so as to more accurately depict customer risk, revenue, value, capital hunger, etc.

Two application scenarios for customer-level scoring

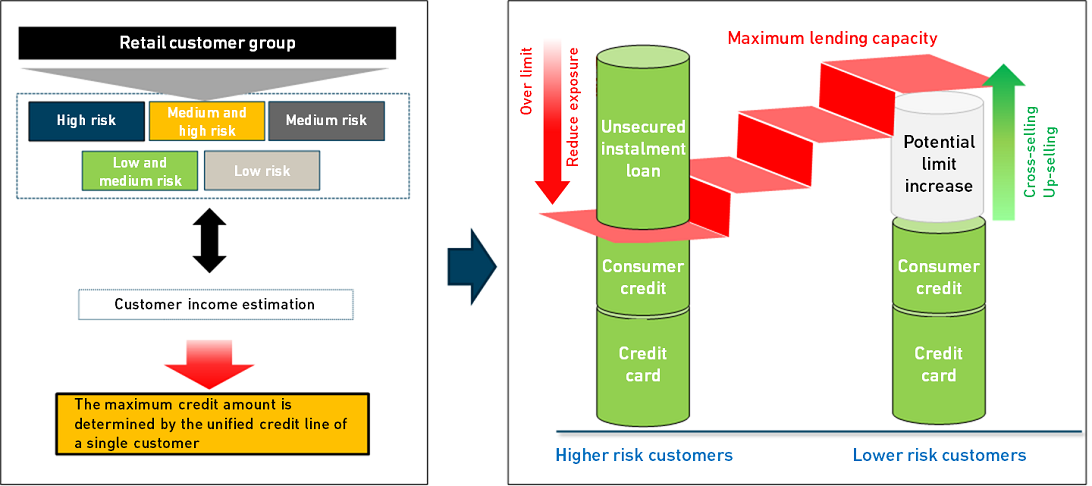

As mentioned above, personal comprehensive credit line system is the first major application of customer-level scoring, which is usually divided into three levels: 1. Single product level limit exposure within the bank; 2. Total Internal limit exposure within the bank; 3. Total internal and external limit exposure in the entire credit lending market. For customers with multiple credit products, the total amount of credit granting of other banks and the total amount of accumulated used loans data should be considered to avoid excessive credit granting.

The core of the whole credit limit system is the unified risk quantification tool and the customer-level income estimation model. Most banks have comprehensive application scoring models and income verification and recognition methods in the pre-loan approval stage. However, for customers in the loan stage, it is difficult to dynamically manage the maximum limit, which is often called “rigid deduction” dynamic tracking and necessary management, due to the lack of risk quantification tools and income estimation model of the unified scale. The customer-level scoring mentioned above has unified the risk scale. Therefore, the income estimation model is set up based on the customers with verified income in the bank by virtue of personal information, credit bureau information and assets in the bank. Then the models can be validated and calibrated for the customers without verified income.

Establishing the personal comprehensive credit granting system not only solves the problem of high risk and high co-debt customers’ excessive limits, but can also actively cross-sell or increase the limit of customers with relatively low risk and considerable revenue potential, so as to stimulate customers’ further usage, improve revenue and drive customer stickiness.

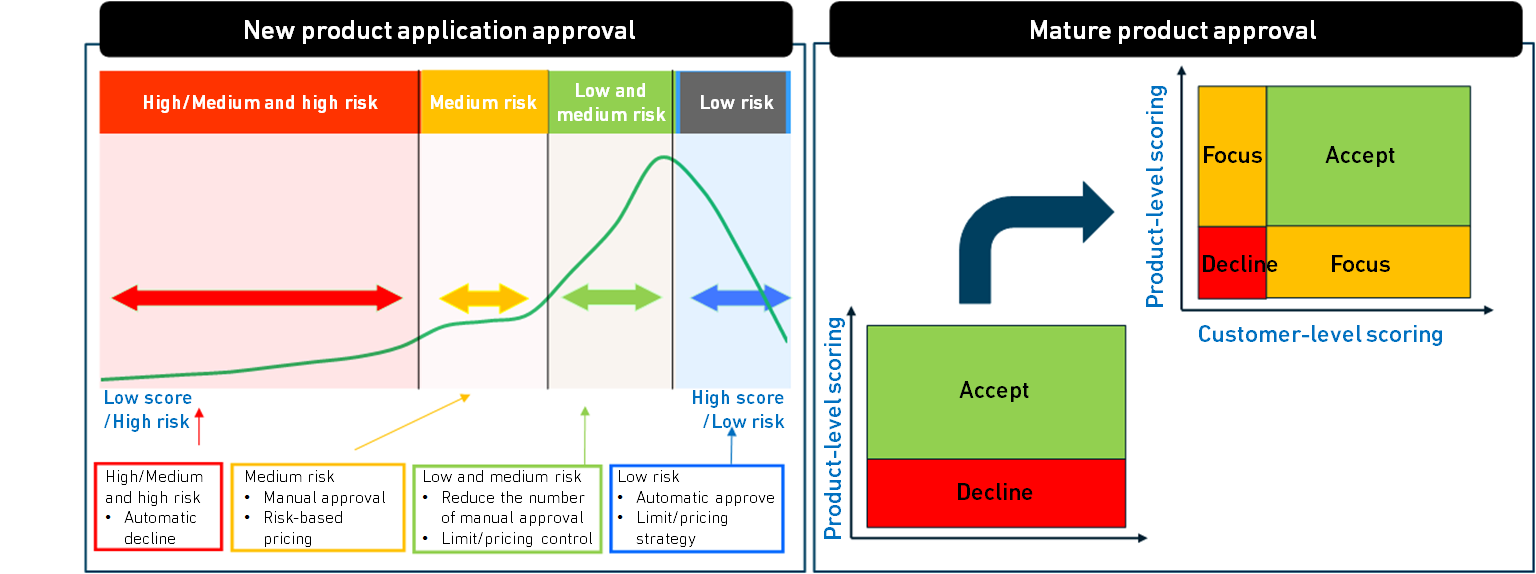

The second major application of customer-level scoring is to improve application approval strategies. In recent years, banks continuously launched new products to better serve customers with different needs or from different channels. However, the accumulation of historical data of new products and customer groups from new channels is often insufficient to develop the data-driven application scoring model on customised products. In this regard, banks often adopt the scoring model of similar products, or rely on the expert scoring model of peer experience, or purchase the external general scoring model to temporarily solve the problem. Compared with the above options, the customer-level scoring developed based on the bank’s ecosystem data is more consistent with the characteristics of the customer group and the risk portrait of the bank, and is often significantly superior to the above transitional scheme in terms of differentiation ability and stability.

In addition, for the application approval of mature credit products, the decisioning can also be processed based on both product-level and customer-level scoring, to identify risks more accurately and carry out targeted swap in/out, further control risks and improve the approval efficiency and approval rate.

Ecological evolution of customer-level scoring

With the deepening of customer-level risk and operation strategies, data mining technology and modelling methods are also gradually evolving, and application scenarios and corresponding strategies are increasingly rich. The credit management of some advanced banks is trying to shift from customer-centric to family-centric, considering the solvency and credit demand of families, and integrating credit loans and mortgage loans into a single credit line and loan management system. Some banks have applied this concept to the loan field of small and medium-sized enterprises, implementing dual-dimensional risk evaluation and comprehensive credit line management for small and medium-sized business owners and enterprises, improving the level of ecological operation, driving customer stickiness, and ultimately improving returns and controlling risks.

Faced with the ever-changing macroeconomic environment, products, channels and customer groups, we sincerely hope that this article can inspire and resonate with you.