KUALA LUMPUR, 01 NOVEMBER 2022 – Experian Information Services (Malaysia) today announced its Trade Bureau Industry Debts Turned Cash (i-DTC) study which measures credit repayment data between September 2020 to August 2022. In this analysis, Malaysian companies and SMEs were examined across seven key industries including: Construction, and Hospitality/Food & Beverage.

Dawn Lai, Chief Executive Officer of Experian Information Services (Malaysia), says “Our i-DTC study examines the impact of the COVID-19 pandemic on Malaysian businesses, both large and small. This together with Experian’s extensive credit data provides valuable data and analysis for future events of a similar nature, giving business stakeholders more actionable insight into the broad measures, both at entity, economic and fiscal levels, to build a more resilient and sustainable economic ecosystem for Malaysia in the face of a more volatile global economy.”

Overview: Malaysian companies and SMEs make broad cash flow recovery

Malaysia’s economy has gone through challenging times because of the pandemic and external factors like geopolitical tensions and the rise in global commodity prices leading to inflation. SME Bank’s inaugural SME Sentiment Index has shown a positive reading of 53.8, which indicates that SMEs are optimistic about the current economic recovery phase, however, many are still in need of financing aid to manage their working capital and struggle with rising operating costs due in part to supply chain disruptions, higher raw material prices and increased labour costs.

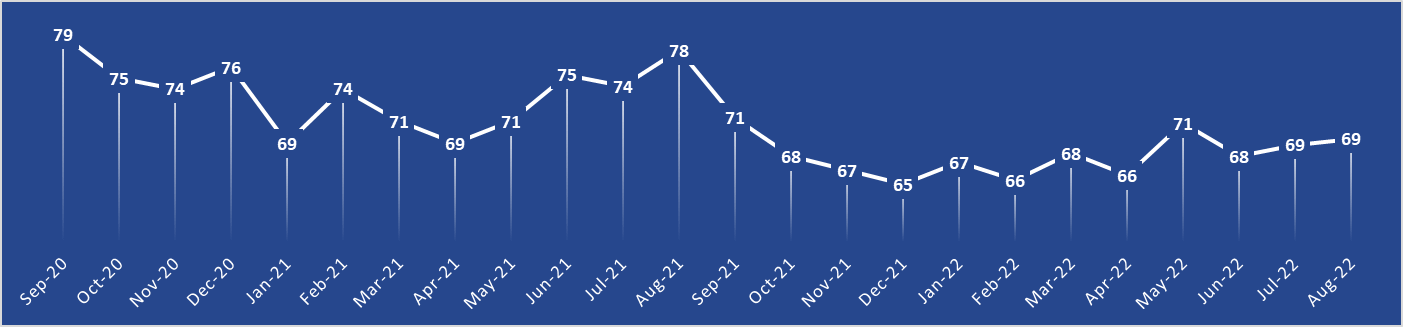

Figure 1: Experian i-DTC by months (Sep 2020 – Aug 2022)

The average Experian i-DTC on a rolling 12-month basis has reduced (74 days in July 2021 vs 68 days in June 2022). This indicates that there is a broad cash flow recovery for the last 12 months as compared to the same time last year. This is largely due to the opening of the economy in normalising trading activity and strengthening the economy towards recovery and growth. Malaysia’s GDP growth in the second quarter of 2022 rose by 8.9% and this growth momentum is likely to continue in the second half of 2022. In addition, recent official estimates are still buoyant despite inflationary pressures, a weakening Ringgit and trading conditions influenced by geopolitical tensions around Asia and the conflict in Eastern Europe.

Corporations vs SMEs

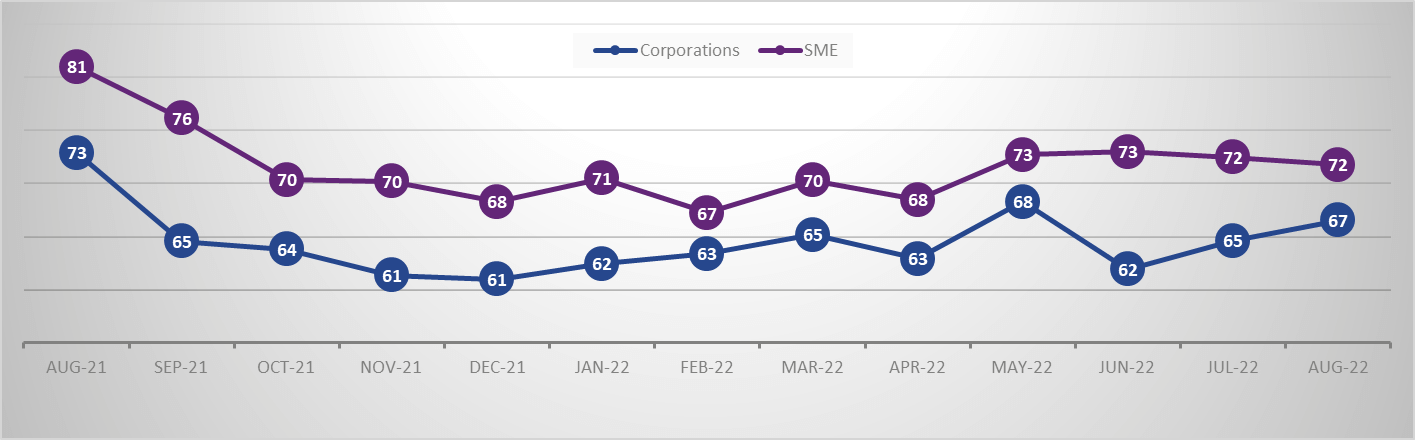

Corporations have been able to weather liquidity pressures, and their ability to borrow remains stronger than their SME counterparts. Conversely, SMEs have seen a softening of cash flow stresses, but recovery is flat around 72-73 days from May to August 2022. Smaller enterprises remain cash vulnerable particularly with recent inflationary pressures, competition for labour, difficulty in securing loans and the rising cost of borrowing (interest rates). Additionally, SMEs continue to struggle to take full advantage of the post pandemic rebound in the economy. Compounded by the slower uptake of digitalisation in certain segments, the absence of building scale and access to liquidity are among the areas continuing to challenge their cash positions.

Figure 2: Experian i-DTC Corporations vs SMEs (August 2021 – August 2022)

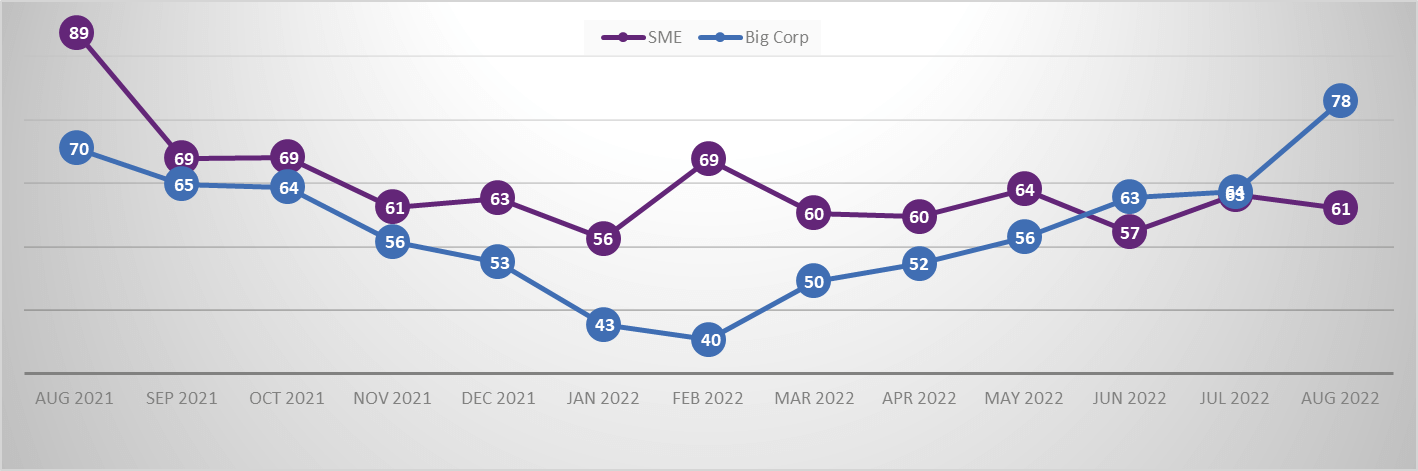

SMEs in the Hospitality / F&B sector recorded the biggest recovery on a YOY (Year-On-Year) basis, with an i-DTC of 89 days over the same month last year (August 2021), improving by 28 days to 61 days in August 2022. The easing of travel restrictions in April 2022 has had a positive impact on both inbound and outbound tourism. According to CBRE Asia Pacific’s latest report, Kuala Lumpur Hotel Market Outlook & Prospects 2022, more than 3,000 new hotel rooms and hotel suites are slated to open in Kuala Lumpur this year. Also, between 2023 and 2025, 1,260 new hotel rooms will be available. Restaurants, cafes, and those in the food business are also seeing increased foot traffic, improving their sales performance. Liquidity and access to capital remains key to SMEs in this sector as they seek near-term expansionary measures to scale their operations for growth.

On the other hand, corporations in this sector are demonstrating a reverse trend of slower payments in recent months since early 2022. With the country having entered an endemic phase of COVID-19, access to manpower continues to challenge hoteliers, travel agencies, restaurants and cafes in scaling their business to full capacity, despite growing domestic and international demands. Many in the sector have called for the government’s support to expedite foreign worker approvals to meet urgent manpower requirements to drive recovery.

Figure 3: Experian i-DTC Hospitality/F&B Corporations vs SMEs (August 2021 – August 2022)

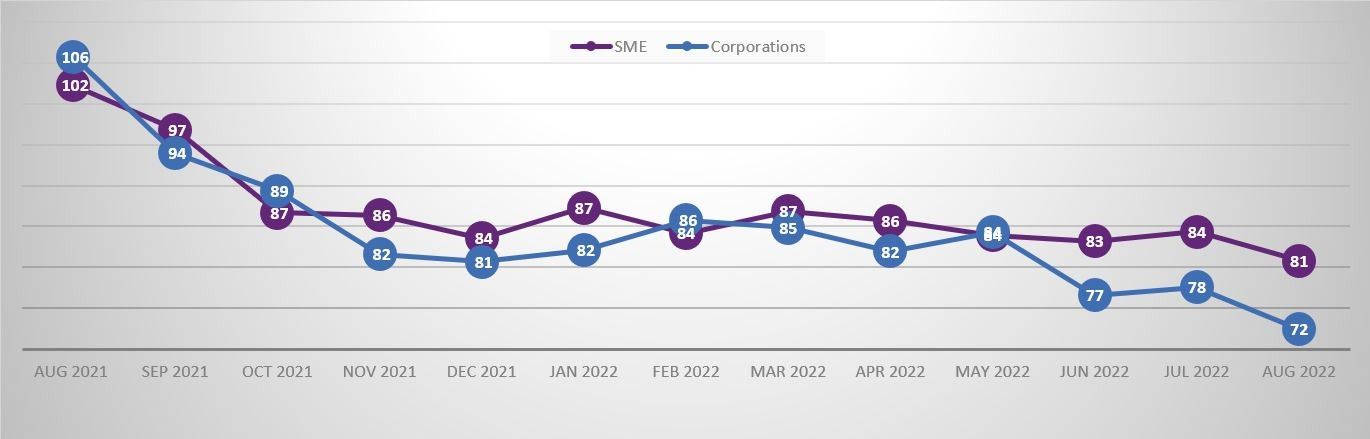

In the Construction sector, corporations and SMEs benefited from recovery in the sector across the last 12 months. The government has implemented various initiatives to support the construction sector to bounce back from the impact of the global economic crisis. This includes the plan to establish the Public Private Partnership (PPP) 3.0 model, a specialised mechanism to fund infrastructure projects in the 12th Malaysia Plan (12MP) between 2021 and 2025, as well as several incentives to improve employment rates and support businesses. Compared to a year ago, Construction SMEs have managed to see a 21-day improvement from August 2021 to August 2022. Conversely, the large corporation construction sector has also seen a 34-day improvement over the same period as construction projects and activity resume.

Figure 4: Experian i-DTC Construction Corporations vs SMEs (August 2021 – August 2022)

Maria Liu, Managing Director, Greater China and Southeast Asia, explains: “With global inflationary pressures expected to persist, it is commendable that the government continues to provide support through the many subsidies put forward for Budget 2023 to help Malaysia weather the headwinds. From our observation, monitoring of suppliers, clients and cash flow continues to be important for Malaysian companies to be able to ride through the tides of uneven economic recovery. Cash preservation will continue to be the focus for smaller Malaysian enterprises where they have less ability to demand preferential credit terms from their clients.”

As outlined by the government in Malaysia’s Digital Economy Blueprint (MyDIGITAL), companies will also need to understand the importance of big data and being data-driven. “This will help SMEs have tangible results and be able to predict their customers’ actions. SMEs can succeed by making a concerted effort to enhance their knowledge, digital capabilities, and managerial practices,” adds Liu.