Hong Kong, March 8, 2019 — Experian, the world leader in information services, and Hong Kong-based charity Enrich recently announced the findings of a Market Intelligence Report on migrant domestic workers (MDWs) by Frost & Sullivan. The Value of Care: Key Contributions of Migrant Domestic Workers to Economic Growth and Family Well-being in Asia study surveyed 300 MDWs in Hong Kong, Malaysia and Singapore on their personal finance habits and contributions to the economy.

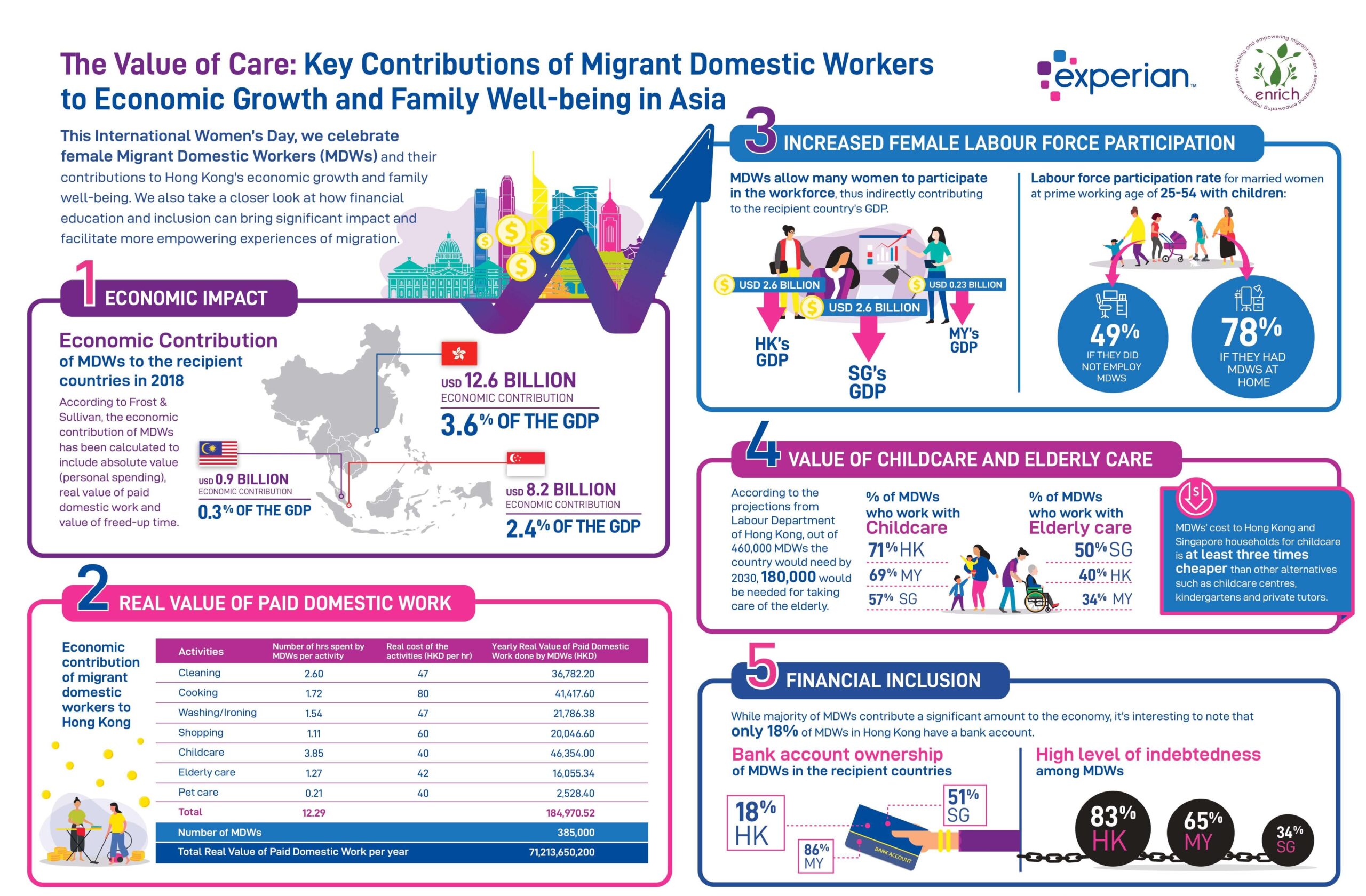

The report revealed that nearly 50% of MDWs in Hong Kong, Malaysia and Singapore do not have a bank account, illustrating a low level of financial access and literacy amongst MDWs in the region. This is despite the significant economic contributions by MDWs to the countries they work in. The research shows that in 2018, MDWs contributed an estimated USD$12.6 billion (HKD$98.9 billion) to Hong Kong’s economy, representing 3.6% of the GDP. MDWs contributed USD$8.2 billion (SGD$11 billion) to Singapore’s economy (2.4% of the GDP) and in Malaysia, USD$0.9 billion (MYR3.8 billion), 0.3% of the GDP.

Sisca Margaretta, Chief Marketing Officer of Experian Asia Pacific, said, “Building equal opportunities for inclusion across genders and socio-economic groups is key to developing thriving economies and communities in Asia Pacific. Only by arming all groups with financial knowledge and access will we be able to start addressing the financial difficulties they face and help resolve the region’s financial inclusion challenges.”

Filling the care gap

With rapidly ageing populations, lower fertility rates, and little or no affordable care services, over 21 million MDWs currently fill the care gap in Asia and the Pacific, in response to an increasing demand for paid domestic work.

This demand is only set to grow in the future; in Hong Kong the government has projected a total need of 600,000 MDWs by 2047. As more doors open for MDWs across Asia, the future of care in Hong Kong depends on ensuring that it remains an attractive city to work in.

The real value of care

Domestic work is easy to overlook, but noticeable when it isn’t there. It requires a diverse skill set, including direct elements of care (of children, the elderly, the disabled) and indirect elements such as cleaning, cooking etc.

“Migrant domestic workers are the unsung heroes of our socio-economic future. Their contributions significantly benefit economies across the region, the families they provide for in their home countries as well as the -households they work with and support,” said Margaretta.

In this report, the final contribution figure has been calculated according to the real value that MDWs add based on the cost of domestic work if paid at local rates, the value of their own personal spending in Hong Kong and value of freed-up time. For example, MDWs enable dual incomes in each household by freeing more women to join the workforce. Employing MDWs has a direct effect upon increased female labour force participation, effectively enabling other women to further their careers.

In Hong Kong, only 49% of women (at the prime working age of 25-54) with children would be able to join the labour force if they did not employ an MDW. However, if they do employ an MDW, this labour force participation increases to 78%. By enabling more women to join the labour force, MDWs indirectly add USD$2.6 billion (HKD$20.1 billion) to Hong Kong’s economy, USD$2.6 billion (SGD$3.5 billion) to Singapore’s economy and USD $0.23 billion (MYR929 million) to Malaysia. This has an additional contribution to family well-being.

Moving towards financial inclusion

Despite their important contribution, this research also shows a significant lack of access for MDWs to participate in Hong Kong’s thriving economy, and points at financial inclusion as a way to improve the experience of migrants in the city.

In an economic hub like Hong Kong, only 18% of MDWs have bank accounts. Barriers to accessing these financial services include lack of financial knowledge and awareness, strict regulations to open bank accounts, and a lack of funds. There is also a concerning high level of debt amongst MDWs in the city, with, and 83% reporting being in debt in Hong Kong. These figures contrast with those from Singapore and Malaysia, where 51% and 86% of MDWs have bank accounts, and 34% and 65% of them have reported to be in debt, respectively.

Considering this, Lucinda Pike, Executive Director of Enrich, said, “Despite their valuable contributions, migrant domestic workers often lack the financial access and awareness they need to unleash their full economic potential. Financial education is a life-changing solution that will address this gap. Our continuous partnership with corporate organisations such as Experian will empower and enable migrant domestic workers with the knowledge to further secure their financial futures.”

Care for the future: Ensuring domestic and care work provisions

This report reveals that MDWs contribute significantly to Hong Kong’s economy, but yet are largely financially excluded and often return home financially worse off.

If Hong Kong plans to keep relying on MDWs to fill this care gap, it needs to make sure it remains an attractive city to work in. Taking steps to recognise the economic value of care and domestic work is therefore necessary to ensure future provision of care workers. Failing to do so could lead to strains on the availability of care, having knock-on effects to the wider economy and family well-being.

“The report findings highlight areas that require urgent action. Beyond leveraging alternative data to build financial identities for the region’s unbanked, Experian is collaborating with social organisations, such as Enrich in Hong Kong and Aidha in Singapore, to spearhead financial education and mentoring programmes for migrant domestic workers,” added Margaretta.

TABLE 1: Recommendations from this report

|

Improve educational opportunities and financial literacy training to ensure MDWs are equipped with the knowledge to ensure their long-term financial security. |

|

Increase financial inclusion by implementing policies that enable greater access to financial services, including easing regulations for MDWs to open bank accounts, and providing alternative ways to save money. |

|

Better regulation over financial organisations. Given the finding that many MDWs turn to the ‘unstructured’ sector to borrow money instead of formal institutions (e.g. money lenders), placing themselves and their employers at higher risk, there needs to be better regulation over these providers and a reduction in the cap of interest that can be legally charged. |

|

Acknowledge domestic work as skilled work and provide skills development and recognition. Hong Kong will need to recognise domestic and care work as skilled work, for example through upskilling schemes or other professional qualifications, and find ways to retain and attract MDWs. Early planning would ensure a more stable future of care for all. |

|

Recognise that this is a multi-faceted issue which requires strong collaboration between MDWs, employers, governments, corporates and civil society. |

About Enrich

Enrich is the leading Hong Kong charity promoting the economic empowerment of migrant domestic workers. We empower migrant domestic workers to invest in themselves through financial and empowerment education. Our workshops equip domestic workers with the tools to save, budget and plan for a future with greater financial security while they are here in Hong Kong.

According to a recent CUHK study, 96% of Enrich’s participants begin tracking their expenses following Enrich’s workshops. Please visit www.enrichhk.org for more information.