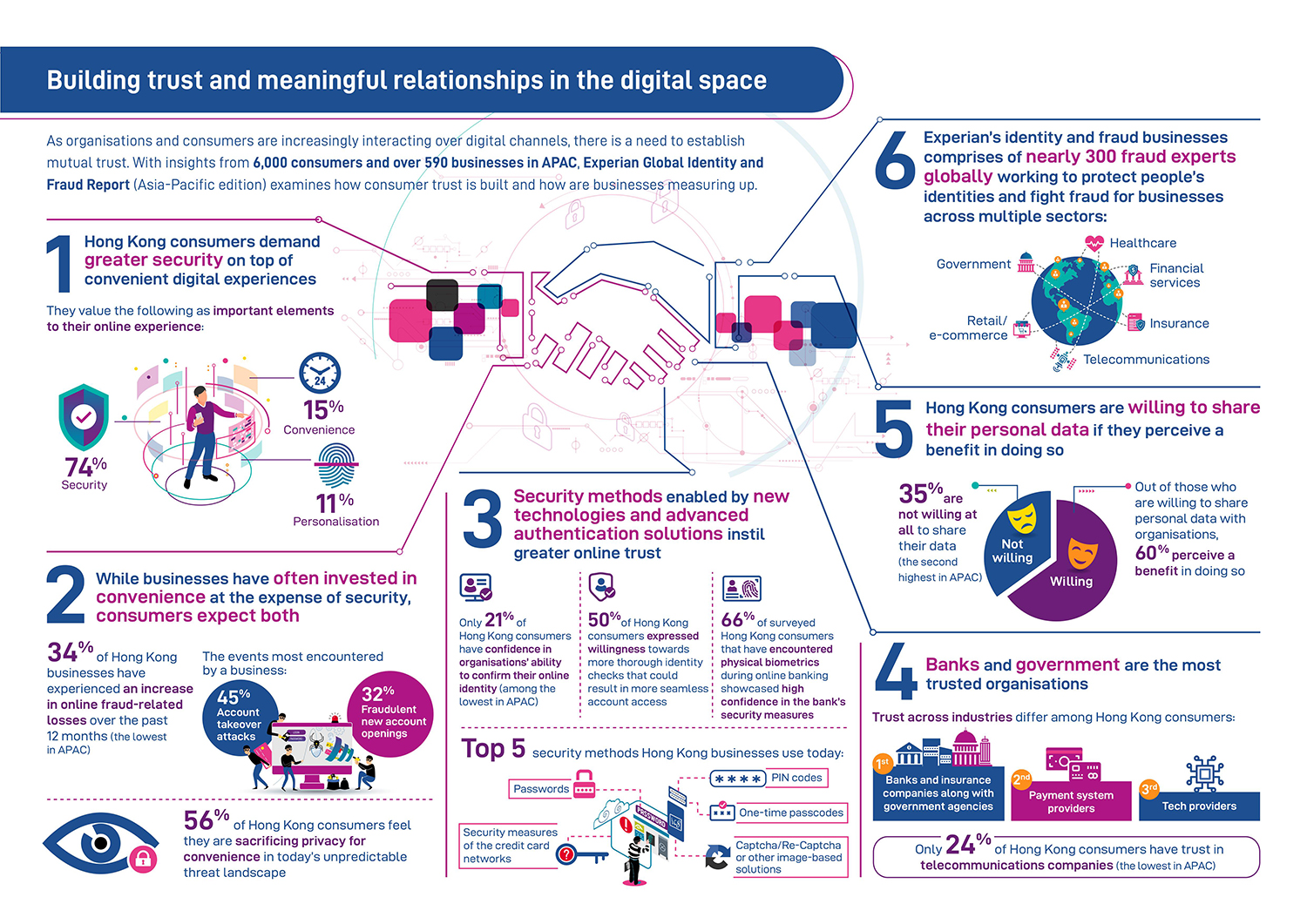

- Hong Kong consumers demand greater security on top of convenient digital experiences

- While businesses have often invested in convenience at the expense of security, Hong Kong consumers expect both

- Security methods enabled by new technologies and advanced authentication solutions instil greater online trust

Hong Kong, April 25, 2019 – As organisations and consumers are increasingly interacting over digital channels, there is a need to establish mutual trust. Experian, the world’s leading information services company, recently released its 2019 Global Identity and Fraud Report Asia-Pacific (APAC) edition. Based on insights from 6,000 consumers and over 590 businesses in APAC (China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Singapore, Thailand, Vietnam and Australia), the report examines how consumer trust is built in today’s digital-obsessed environment and how are businesses measuring up. It also highlights that trusted online relationships are based on businesses providing both a secure environment and seamless consumer experiences.

Consumers have higher than ever expectations for their experiences online and demand better and more secure services. Experian’s Identity and Fraud Report provides insights into local consumers’ top concerns during their online experience that would enable Hong Kong businesses to better understand their customers and meet their needs.

“For the most part, businesses are doing a good job of delivering their products and services via the digital channel but now is the time to look at how businesses and consumers trust the online channels and how can they create greater value,” said Jian Huang, Managing Director of Experian Greater China. “With increasing fraud incidents, businesses have an imperative to deploy advanced technologies, to protect consumers’ information and at the same time, enhance their experiences.”

Hong Kong consumers demand greater security on top of convenient digital experiences

The rapid development of digital channels has changed the way consumers interact with businesses, moving from face-to-face transactions to anonymous relationships built on trust. Difficult to achieve and earned over time, trusted online relationships are based on businesses providing a secure environment and a convenient customer experience. APAC consumers are most concerned about “security” during their online experience, especially in Hong Kong where 74 percent of surveyed consumers see security as the most important element of their online experience, followed by convenience (15 percent) and personalisation (11 percent).

On the contrary, most Hong Kong businesses tend to focus on offering a convenient experience first. 65 percent of Hong Kong businesses believe it’s better to err on the side of permission and, as a result, risk the cost of fraudulent transactions as part of doing business online to create a more convenient online experience (higher than the APAC average of 58 percent). By comparison, only 46 percent use consumers’ information to create a more secure transaction environment (lower than the APAC average of 54 percent), and triggered by the desire to increase trust, 40 percent plan to invest more to proactively create greater transparency in the use of customer information (lower than the APAC average of 58 percent).

The traditional notion that cyber security and convenience are two opposing forces is outdated. By increasing investment, businesses can combat fraud while providing consumers a seamless online experience. Only in this way can strong mutual trust be established between businesses and consumers. Experian’s identity and fraud business comprises of nearly 300 fraud experts globally working to protect people’s identities and fight fraud for businesses across multiple sectors, including government, healthcare, financial services, retail/e-commerce, insurance and telecommunications.

While businesses have often invested in convenience at the expense of security, consumers expect both

Despite fraud losses being among the lowest worldwide, businesses across all markets in APAC can agree on one thing – fraud is a major concern. 50 percent of surveyed APAC businesses have seen an increase in fraud losses over the past 12 months. Fraud losses were particularly prominent in India at a reported 65 percent and lowest in Hong Kong at 34 percent.

However, 56 percent of Hong Kong consumers surveyed feel they are sacrificing privacy for convenience in today’s unpredictable threat landscape.

Among the fraudulent events most encountered by Hong Kong businesses, 45 percent are account takeover attacks and 32 percent are fraudulent new account openings – both potentially damaging to brand reputation. 63 percent of Hong Kong businesses reported an increased concern for fraud losses since last year.

Security methods enabled by new technologies and advanced authentication solutions instil greater online trust

While consumers have continued confidence in traditional methods, those who have been exposed to advanced authentication methods like physical or behavioural biometrics, account information, artificial intelligence and customer identification programmes tend to have a greater confidence in these methods than consumers without prior exposure.

The top four security methods that APAC consumers encounter today are: passwords, PIN codes, physical biometrics and security questions. Three quarters of surveyed APAC consumers find high confidence in their bank’s security measures if they encounter biometrics – whether physical or behavioural – during an online banking activity.

APAC businesses have started embracing biometrics or other advanced methods to recognise their customers better or prevent fraud. This includes the roll-out of facial recognition for account openings or voice recognition that identifies the customers while they state the nature of their call.

According to the report, however, only 21 percent of surveyed consumers in Hong Kong indicate that they have complete or very high confidence in businesses’ ability to safely confirm their online identity (among the lowest in APAC). 50 percent of Hong Kong consumers expressed willingness towards more thorough identity checks that could result in more seamless account access.

Banks and government are the most trusted organisations

60 percent of surveyed APAC consumers place a high level of trust in banks and insurance companies in handling their personal data, followed by government agencies (57 percent) and payment service providers (56 percent). Hong Kong consumers have the highest trust in banks and insurance companies along with government agencies, followed by payment system providers and then tech providers. Only 24 percent of Hong Kong consumers trust telecommunications companies (the lowest in APAC).

Hong Kong consumers are willing to share their personal data if they perceive a benefit in doing so

Most APAC consumers are willing to share personal data, such as financial, commercial and biometric data or contact information, with organisations to gain a better future digital experience. However, most Hong Kong consumers are significantly more hesitant about sharing. 35 percent of Hong Kong consumers are not willing at all to share their data, second only to mainland Chinese consumers at 37 percent in APAC.

Out of those who are willing to share personal data with organisations, 60 percent perceive a benefit in doing so. Therefore, if there are opportunities for businesses to provide a better digital experience that is secure, consumers may be more willing to share their personal data.

“The fast-growing adoption of smartphones and increased internet penetration have created an ecosystem that enables consumers to embrace digital technology across multiple areas of their life. Unlocking an entirely new digital lifestyle is rewarding for both businesses and consumers, but it comes with challenges,” Huang added. “As a world-leading information services company, Experian is committed to partnering with businesses to combat fraud and automate their decisions with new data and analytical tools, thus successfully coping with the increasingly fierce market competition and the opportunity of winning customers’ trust.”

The full Global Identity and Fraud Report – Asia-Pacific edition can be downloaded here.