- SMEs are moving beyond preservation mode to leverage new opportunities, even as economic recovery remains gradual and uneven across sectors

- Construction / Engineering and Business Services sectors registered the greatest improvement in sentiments as recovery gathers pace

- Construction / Engineering sector is the only sector to register a reading above 50, signalling expansionary sentiments driven by a partial uplift of construction demand

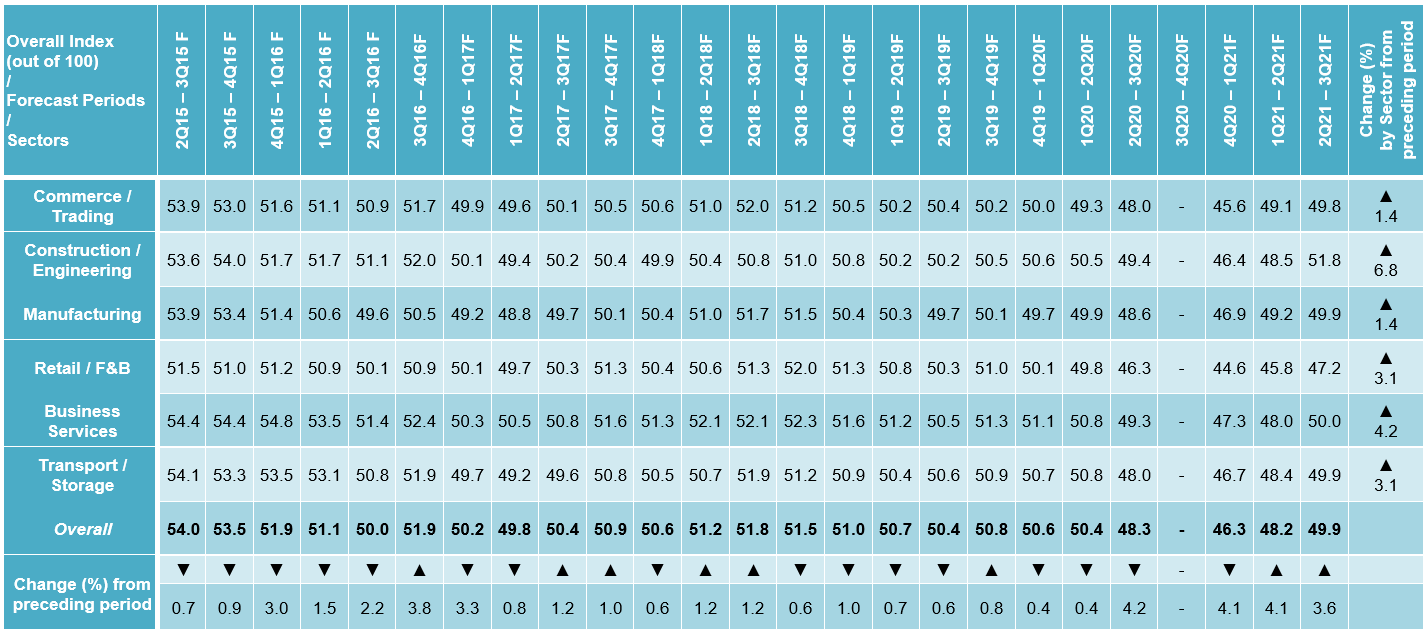

SINGAPORE, 7 April 2021 – The SBF-Experian SME Index (“the Index”), a joint initiative of the Singapore Business Federation (SBF) and Experian, measures the business sentiment of SMEs across six key sectors1 in Singapore for the next six months (April – September 2021). Based on a survey conducted between 18 January and 26 February 2021 of more than 2,100 local SMEs, the Index for 2Q21 – 3Q21F registered an overall reading of 49.92, which is an increase from the 48.2 reading in the previous quarter. This is also the highest reading since the start of the COVID-19 pandemic in 1Q20.

Economic activities worldwide have resumed largely after the contraction seen in 2020, with the IMF forecasting a global growth rate of 5.5% for 2021, boosted by expectations of stronger policy support as well as vaccination campaigns. In Singapore, the Ministry of Trade and Industry (MTI) has maintained a growth outlook of 4.0% to 6.0% for 2021.

Outlook for 2Q21 – 3Q21F (April 2021 to September 2021)

[Survey Period: 18 January 2021 to 26 February 2021]

*Note: 3Q20-4Q20F data collection paused due to Circuit Breaker

Rising Business Sentiment Among SMEs Amid Signs of Economic Recovery

Following a record low business outlook in 2020, SMEs across all six sectors registered an improvement in business sentiments. The most significant gains were for internal-facing sectors such as Construction / Engineering (increased 6.8% from 48.5 to 51.8) and Business Services (increased 4.2% from 48.0 to 50.0). This is likely due to the easing of COVID-19 restrictions, which has enabled the resumption of business activities on a broader scale.

SMEs also registered improvements across all seven qualitative indicators3. Most significantly, SMEs are expecting an easing of their Access to Financing (increased 11.59% from 4.92 to 5.49) for the first time since 2Q19 – 3Q19F. With the easing of business restrictions, most SMEs are anticipating a rebound in sales over the next six months. Turnover expectations have improved by 8.59% to 4.93 (from 4.56). Five out of six sectors surveyed showed improvements in this indicator, led by the Business Services (increased 21.46% from 3.96 to 4.81) and Construction / Engineering (increased 16.56% from 4.53 to 5.28) sectors. This could be attributed to the steady resumption of business activities as Safe Management Measures ease.

SMEs are also anticipating an improvement in Profitability expectations, which increased by 9.42% to 4.88 (from 4.46). Business Services (increased 22.34% from 3.85 to 4.71) and Construction / Engineering (increased 13.63% from 4.55 to 5.17) sectors posted the largest gains for this indicator. Expectations around Capacity Utilisation also saw an uptick (from 6.46 to 6.73), corresponding to the improved business outlook and activity forecast.

SMEs Looking Beyond Survival to New Growth Opportunities

SMEs have benefitted from the Government’s slew of support measures in 2020. Support is expected to continue into 2021 with an S$11 billion COVID-19 Resilience Package, while S$24 billion has been earmarked over the next three years to help businesses adapt post-pandemic. With the economy poised for a gradual recovery, most SMEs appear to be looking beyond keeping their business afloat and are looking to capitalise on the resumption of business activity over the next six months.

COVID-19 has also drastically changed work processes and practices for businesses. With the advent of remote working on a broad scale and to keep pace with these changes, SMEs have increased their Capital Investment expectations by 2.40% to 5.12 (from 5.00).

A slight improvement in expectations around Business Expansion (increased by 1.98%) suggests that SMEs may be exploring opportunities that were initially delayed by the pandemic. This also marks the reversal of a downward trend observed since 4Q19 – 1Q20F. Expectations around Hiring also registered an increase of 2.54% to 5.24 (from 5.11), likely in support of aspirations in business expansion. The ongoing economic recovery and availability of various government support measures may also have boosted the ability of SMEs to replace and bolster their workforce.

The Commerce / Trading sector was the only sector that registered slight decreases in both Business Expansion (decreasing 0.59% from 5.10 to 5.07) and Hiring (decreasing 2.86% from 5.25 to 5.10) expectations. This could be due to the significant boost that it enjoyed in the last quarter, as well as the persistent downside risks within the international and regional trading environments that may have impacted business opportunities and the hiring appetite among SMEs in the sector.

Battered Construction / Engineering Sector in Recovery

The partial recovery of construction demand and the resumption of activities are key factors contributing to an overall improvement of 6.8% (to 51.8) in the business sentiments of SMEs in the Construction / Engineering sector. Notably, it is the only sector this quarter to register a reading above 50.

The Construction / Engineering sector saw improvements across all seven qualitative indicators. Turnover expectations increased 16.56% to 5.28 (from 4.53), while Profitability expectations increased 13.63% to 5.17 (from 4.55). This sharp rebound is likely due to the resumption of work after the lengthy work stoppages and delays arising from the Circuit Breaker and extended dormitory quarantines in 2020. Meanwhile, Business Expansion expectations also registered an 8.42% increase to 5.41 (from 4.99), while Hiring expectations saw an 8.55% increase to 5.46 (from 5.03). These are likely in support of the sustained recovery in construction demand forecasted for the medium term.

“Following an unprecedented contraction of the Singapore economy in 2020, this year is poised to be characterised by promising signs of a partial and gradual recovery. While SMEs remain cautious in the near term, many are keeping an eye on future business opportunities. This is evidenced by the improved, but still contractionary expectations surrounding Turnover and Profitability, while sentiments around Business Expansion, Hiring and Capital Investment have turned slightly positive. Overall, SMEs appear to be gradually relaxing the wait-and-see approach they had previously adopted as the uncertainty dominating preceding quarters begin to recede,” said James Gothard, General Manager, Credit Services & Strategy, Southeast Asia, Experian.

Despite a surge in global economic activity, the World Bank states that the economic recovery remains at risk of being derailed by a resurgence of COVID-19 infections or any delays in vaccination campaigns, impacting business confidence and trade activity.

“Due to ongoing downside risks posed by COVID-19, it will remain important for SMEs to boost their overall resiliency towards any unexpected shocks to the global economy. With government support schemes for SMEs continuing into 2021, SMEs will need to explore and invest in aspects such as manpower upskilling and digitalisation, both of which could help firms remain competitive and relevant in the long term,” added Mr Gothard.

Mr Lam Yi Young, CEO of SBF, said, “This second consecutive improvement in the reading of the quarterly SBF-Experian SME Index shows that business sentiments among SMEs are on the rise. The gradual reopening of our economy, the easing of business restrictions, and the wide range of Budget measures announced earlier this year have given a much-needed boost to the confidence of our SMEs. Many are looking forward to re-building their businesses after the devastating impact of the COVID-19 pandemic. SBF is also revving up our efforts to support our SMEs with guided assistance and to help them position for recovery and growth.”

1 The six key sectors are Commerce/Trading, Construction/Engineering, Manufacturing, Retail/F&B, Business Services, and Transport/Storage.

2 An Index reading of 50 is neutral. A reading above 50 would indicate that the overall outlook for the next 6 months is positive, the level of business activities is expected to be expansionary, and business sustainability of the SMEs is expected to be promising. An Index reading below 50 would indicate that the overall outlook for the next 6 months is negative, the level of business activities is expected to be contractionary, and business sustainability of the SMEs is expected to be poor.

3 The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation, and Access to Financing.